The current stage of your organization should steer your decision on how to secure funding. There are several sources of funding for startups, from accelerators, to venture capitalists, EU funds, and loans. The challenge is matching the appropriate financing method to the scale of the project and, as often turns out, its final implementation. We examine the advantages and disadvantages of various models for financing technological projects.

Below you will find:

- Funding for startups – a must-have before takeoff

- Attracting investors for a startup

- When is bootstrapping a good idea?

- The Power of Crowdfunding

- EU Funds for startups

- Loan for a technology company

- Financing for a startup. Which one do you choose?

Funding for startups – a must-have before takeoff

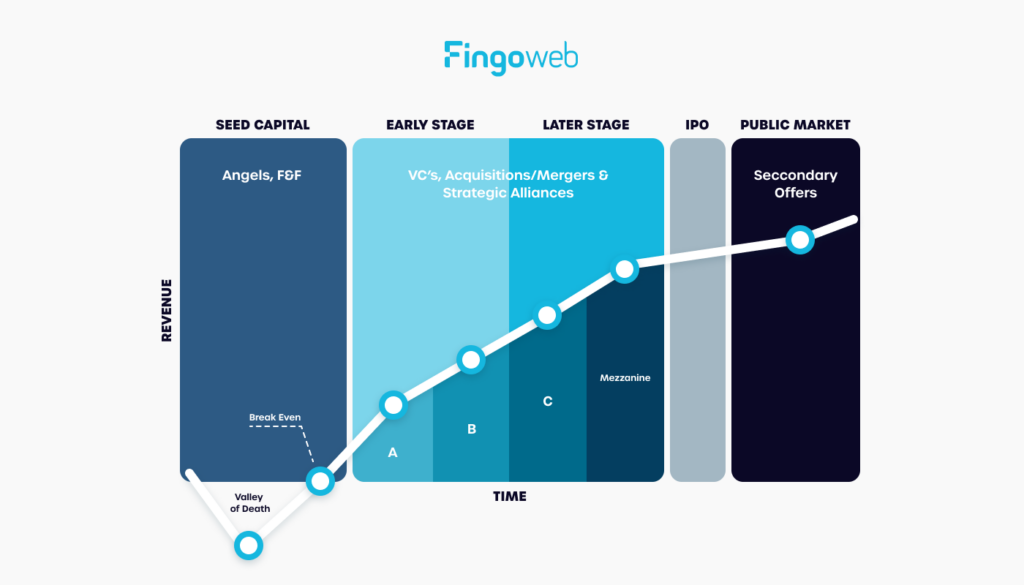

Financing startups is a broad topic, so remember that we are only gathering the essential information. A large portion of technological startups do not reach self-sustainability. The “Valley of death” is a moment in the startup’s life cycle when it consumes resources without generating sufficient income, and it is likely the moment you are facing.

If you only have an idea and do not have a functioning organization behind you, there are two options:

- Self-financing the project also known as bootstrapping – family, friends, personal contribution.

- Obtaining external financing – venture capitalists, business angels, government programs.

As a rule, governmental funds and banks engage with already operating organizations, so you’re looking into the private sector.

It is essential to determine the stage at which your organization is to assess what type of funding works best for you. For example, a large organization with a new solution has a greater chance of success in discussions with bank representatives or obtaining EU funds, while a startup consisting of two university students without a formal organization will find its place in entrepreneurship accelerators and incubators.

Define the stage of development of your project and the resources you have. This will help in choosing the appropriate method of financing.

Attracting investors for a startup

Let’s begin with the second point: the path for startups to secure external financing from venture capitalists (VCs) or individual investors, also known as angel investors. For now, we will exclude discussions about EU funds and loans. Investors invest at various stages, including two initial ones:

- Seed investment is an investment that focuses on market research, project development, and generating revenue. It occurs at an early stage when there is already an established organizational structure.

- On the other hand, pre-seed investment takes place at an even earlier stage. During this phase, there may not be a formal organization in place yet, but there is a concept and founders involved. If an investor decides to participate, they typically provide smaller amounts of money in exchange for a larger stake in the company.

When is it worth seeking an investor?

A good idea is to seek an investor not based on their budget, but in the context of the knowledge they offer. An experienced investor in your industry brings a wealth of knowledge, contacts, and solutions. The same applies to business angels, who will actively participate in the project’s creation.

The downside of finding an investor at an early stage is that you have to share a larger portion of your business. The stake will depend on the risk, financial needs, and size of the organization.

What do investors look for?

It is important to remember that even the most committed investors aim to make a profit from the project. VCs and business angels, when assessing potential risk and return on investment, pay attention primarily to:

- Founder’s commitment. Do the founders themselves take financial risks, and if so, what kind?

- Team. A startup is primarily made up of people who will execute the project. This can be a list of initially interested specialists or a selected software house.

- Industry. The market value, growth potential, or even trends (such as AI lately) matter when an investor is willing to take risks. It is good to seek industry-specific investors.

- Business model and documentation. What do you already have? How do you plan to solve XYZ problems, etc.? The more specific information, the better.

How to prepare for a meeting with an investor?

The process of seeking funding from external investors is highly structured and formal. Venture capitalists typically require a concise pitch deck, limited to 10 slides, that addresses specific inquiries. Successful candidates are then invited to online meetings, and if they pass the initial screening, they proceed to subsequent rounds.

In the deck, the following information should be included:

- What problem does the project solve, and how does it do it?

- Who will implement the project and what competencies do they have?

- What does the founder(s) expect from the investor?

The process of creating a deck is described in a very specific way by Shaan Puri, an American investor and podcaster.

Bootstrapping Startups

According to last year’s data cited by Bankier.pl, over 73% of Polish startups financed themselves independently, using the Family&Friends method. This is definitely a good idea in a situation where you don’t need huge financial resources and already have a functioning project or organization, even in its simplest form. Here is an example path:

- Use your funds to implement an MVP with the help of an external software house, to avoid incurring fixed costs associated with hiring a full IT team.

- Launch the product and generate initial traffic and revenue. It worked, it’s functioning!

- Based on the first version of the product and the data collected, start a crowdfunding campaign to pre-sell and raise funds for your operations.

The advantage of this solution will undoubtedly be full control over the organization, but at the cost of lacking external VC expertise. With significant VC funding, you can also operate much faster.

When is bootstrapping a good idea?

Self-financing a technological project has a significant advantage over other forms: complete control over the project’s direction. Once the initial version of the product is successfully implemented or data is collected, external financing can still be pursued. However, this time, investors are approached as someone who has already accomplished substantial work, possesses data to substantiate the idea, and demonstrates expertise in project development.

When bootstrapping, keep these key points in mind:

- 📅 IT project delays are unfortunately common. Budgets must account for potential delays, so expect higher expenses than initially planned. Learn more about IT project delays.

- 💼 Seek support from specialists. Engaging external firms can save costs and provide access to experts with experience in executing technological projects.

- 🚶♂️ Take small steps. It’s better to successfully complete a small portion of the project than to accomplish nothing at all. By having a functional slice of your idea, you can progress further by approaching venture capitalists, banks, or seeking crowdfunding support.

- ⏳ Ensure you have ample resources. Maintain reserves of resources, time, and money throughout the project’s duration. Remember that implementation is not the end of the journey – marketing, support, ongoing IT maintenance expenses, and other factors come into play. Additionally, make sure you can sustain yourself during this period.

The Power of Crowdfunding

In the world of crowdfunding, platforms like Kickstarter may have varying reputations and face fierce competition. However, a brilliant idea will always triumph. Crowdfunding offers a fantastic opportunity to maintain independence and support your budget, all while keeping the door open for external financing options.

That being said, it’s important to note that crowdfunding platforms like Kickstarter may not be suitable for every venture. If you’re developing a B2B SaaS product, crowdfunding might not be the right path for you. On the other hand, if you have an exciting consumer product such as a video game or mobile application, you can gather significant funds through crowdfunding.

(P.S. Please keep in mind that platforms like Kickstarter are also excellent places to promote your solution.)

EU Funds

The topic of EU funds for startups and technology companies is extensive and we will address it in a separate article. It’s important to know that there are EU entrepreneurship accelerators available for startups at an early stage. For example, in Poland is the Start-up Platforms for Eastern Poland program, which offers funding of up to 600,000 PLN (150 000 euros).

A reliable source of knowledge and a place to apply for funds is the European Commission Funding Programs page.

Selected EU Accelerators in Poland

As an example, you can check out how accelerators work in Poland:

- Smart UP: This accelerator provides comprehensive support to start-up companies, including know-how, networking opportunities, and mentorship. It also facilitates collaboration between startups, technology adopters, and investors.

- Tech Impact: This accelerator focuses on impact solutions related to the UN’s Sustainable Development Goals Agenda 2030. It raises awareness about the latest technological trends in impact solutions among investors, including PFR Ventures funds.

- Startups Exchange: This program supports Polish startups interested in expanding internationally. It prepares them for entering foreign markets and provides ongoing support.

- Scale Up Green: This Scale UP program helps companies transition from a linear to a closed-loop (circular) business model. It also seeks technological solutions from startups that can be applied in this transformation process. Additionally, the program aims to build corporate knowledge about the benefits of a circular economy.

Loan for a technology company

Commercial banks offer various financial instruments for businesses, including SMEs. However, they have strict requirements, and it’s challenging to secure credit or a loan for a startup without a financial history. Additionally, the financial products offered by banks often have short repayment terms, resulting in a high monthly burden for small companies. Furthermore, loans must be repaid, so it’s important to consider this aspect. If you’re seeking a loan, it’s worth exploring organizations that manage EU funds, as they offer loans with significantly lower interest rates.

Financing for a startup. Which one do you choose?

Finding project financing can be just as challenging as deciding which form of financing is best for your startup. The consequences of this decision will have a long-lasting impact on how you operate your business for years to come.

We specialize in supporting startups and have successfully completed over 100 projects, providing support to our partners at every stage. Discover how we can assist you: